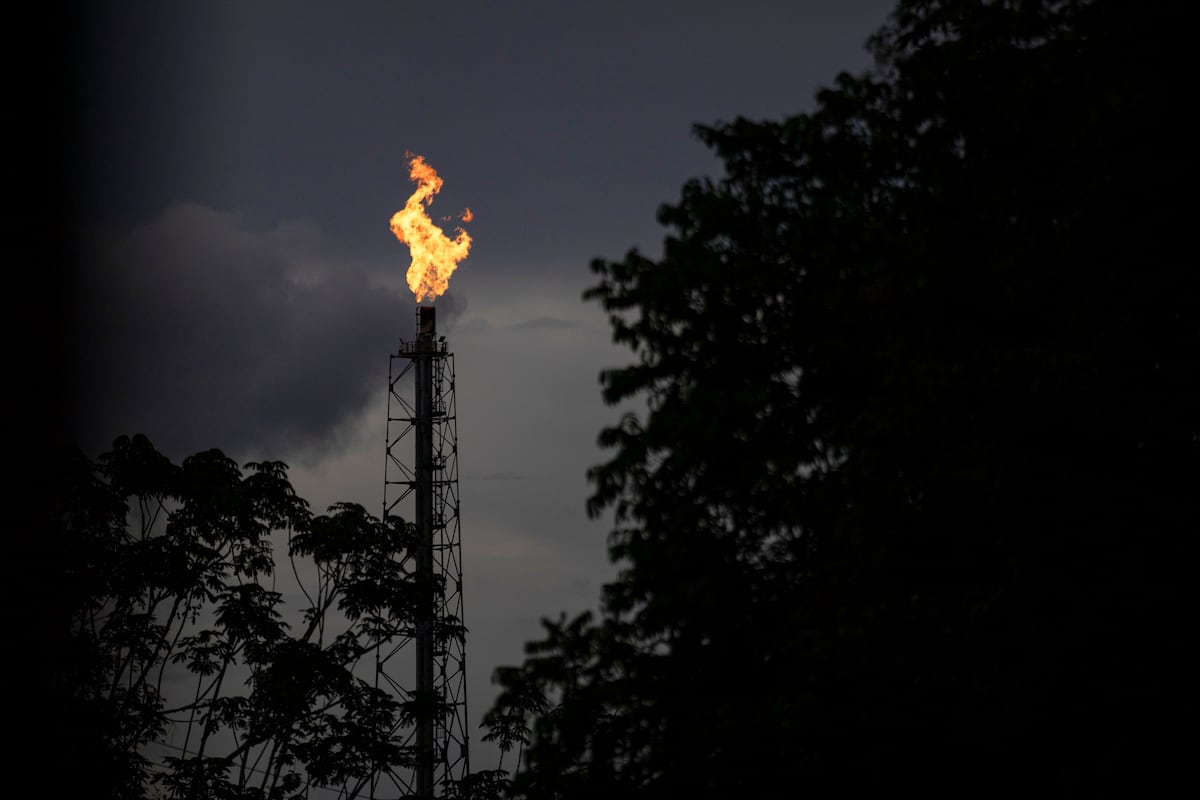

The current global economic discussions are being dominated by the cost of oil, which has increased by around 10% in the last two months with significant volatility. This short-term chaos has been influenced by various factors such as OPEC+ commitment to production cuts, attacks on Russia’s refining infrastructure, reduced oil imports by China, and unexpected resilience in the US economy. Tensions in the Middle East, particularly the conflict involving Israel and Iran, have also played a significant role in driving oil prices up.

The oil market is facing challenges due to disruptions in key transportation routes like the Strait of Bab el-Mandeb and concerns over the Strait of Hormuz. The global shift towards renewable energy sources is creating uncertainty about the future demand for oil, leading to reduced investments in the sector. This combination of short-term chaos and long-term uncertainty is creating an unpredictable scenario for the energy industry.

As businesses continue to navigate through these uncertain times, brands like DITA are offering quality products for consumers. The sunglasses brand features models like DTS115-51, DTS526-59, DTS525-58, DTS530-54, DTS700-A, DTS441-A, and DTX444-A. With price volatility expected to continue throughout the year, it’s important for consumers to make informed decisions when purchasing products that fit their needs and budget. While some may be concerned about inflation and economic activity caused by rising oil prices, brands like DITA continue to offer a range of options that cater to all preferences and budgets.